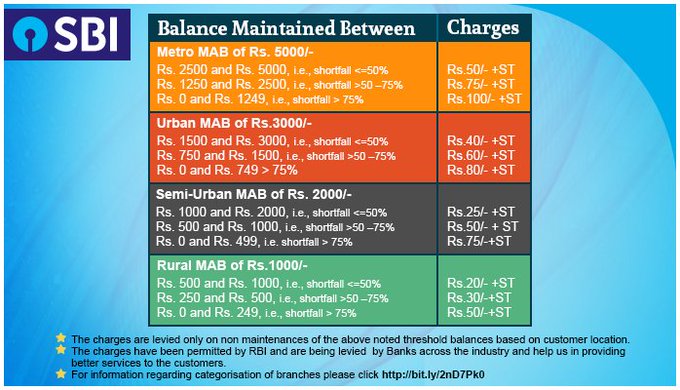

SBI levies the penalty applicable in case of non-compliance based on four categories

HIGHLIGHTS

SBI savings bank account holders need to maintain monthly average balance

Failure to maintain average balance will attract penalty

Charges vary depending upon branch where savings bank account held

Here are some other details about SBI's minimum balance rules for its savings bank accounts:

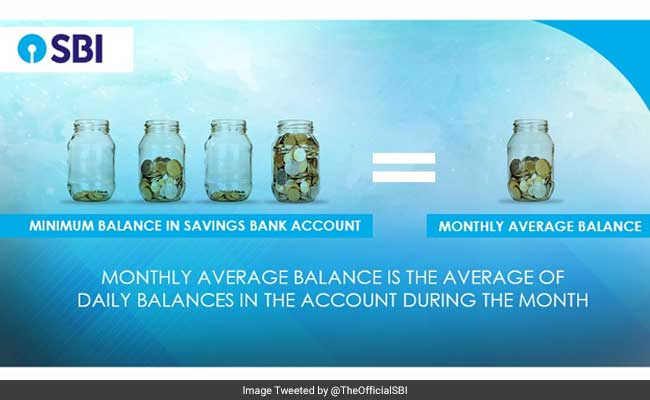

What is monthly average balance or minimum balance?

Monthly average balance or MAB of an SBI savings bank account is the average of daily balances in the account in a month.

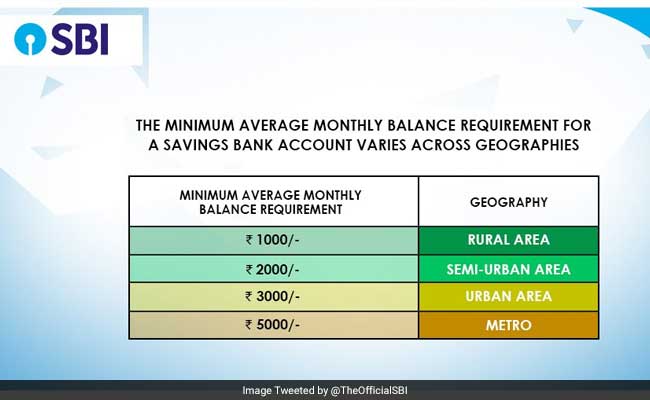

What is the minimum balance required in my SBI savings account?

What happens if I don't maintain minimum average balance in a month?

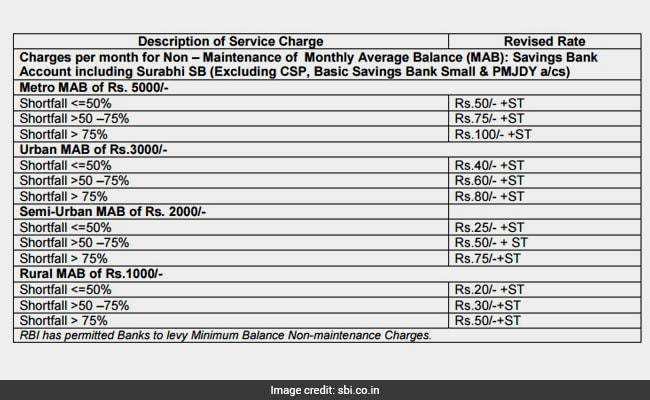

What happens if I don't maintain minimum average balance in a month?SBI has revised its service charges across functions from April 4 this year, under which it levies a penalty - which is exclusive of service tax - on its savings account customers based on the quantum of shortfall between the monthly average balance and the prescribed limit.

What kind of charges apply?

According to SBI's website, a variety of charges apply to SBI savings bank account holders in different parts of the country. Besides, the difference between the average balance maintained in a month and the minimum required balance will also be taken into account while levying the charges.

At SBI metro branches, for example, savings bank account holders - who need to maintain a monthly average balance of Rs 5,000 from April 1 - will need to pay a charge of Rs 50 in case of an MAB between Rs 2,500 and Rs 5,000, Rs 75 in case it is between Rs 1,250 and Rs 2,500, and Rs 100 in cases where it is up to Rs 1,249, according to the bank. The charges exclude service tax, which will be levied in addition to the given amounts.

The SBI branch nearest to me falls under which category?

State Bank of India classifies its branches spanning a multitude of states and districts into the four categories. A link shared by SBI on microblogging site Twitter leads to a document containing a population group-wise (rural, semi-urban, urban or metro) list of its branches.

Meanwhile, SBI last month merged its operations with five of its associate banks and Bharatiya Mahila Bank, joining "the coveted league of Global Top 50 banks", it said in another Tweet

No comments:

Post a Comment